In today’s fast-paced world, accessing financial assistance has become more convenient than ever, thanks to loan apps. Finding the right loan app can make a significant difference in managing unexpected expenses, funding personal projects, or achieving financial goals. However, with numerous options available, it’s essential to make an informed decision. In this guide, we’ll explore the key factors to consider when selecting the perfect loan app that suits your needs as a resident of Manila.

1. Assess Your Financial Needs:

Before diving into the world of loan apps, take a moment to evaluate your specific financial requirements. Are you seeking a personal loan, business funding, or a quick cash advance? Understanding your needs will help you narrow down your search and focus on apps that offer the types of loans you require.

2. Research App Reputation and Credibility:

Trustworthiness is paramount when dealing with financial matters. Look for loan apps that are reputable and have positive reviews from other users. Check if the app is registered with proper financial regulatory authorities in the Philippines, such as the SEC or Securities Exchange Commission, ensuring that your transactions are secure and compliant.

3. Interest Rates and Fees:

Carefully review the interest rates and associated fees of the loan app. Compare these figures with other options available in the market to ensure that you’re getting a competitive deal. Transparent and reasonable rates are indicators of a reliable loan app.

4. User-Friendly Interface:

A user-friendly app can enhance your borrowing experience. Look for an app with an intuitive interface that simplifies the application process, making it easy for you to navigate, submit documents, and track your loan status.

5. Speed and Convenience:

One of the advantages of loan apps is the speed at which you can get approved and receive funds. Opt for an app that offers a quick approval process and disburses funds promptly

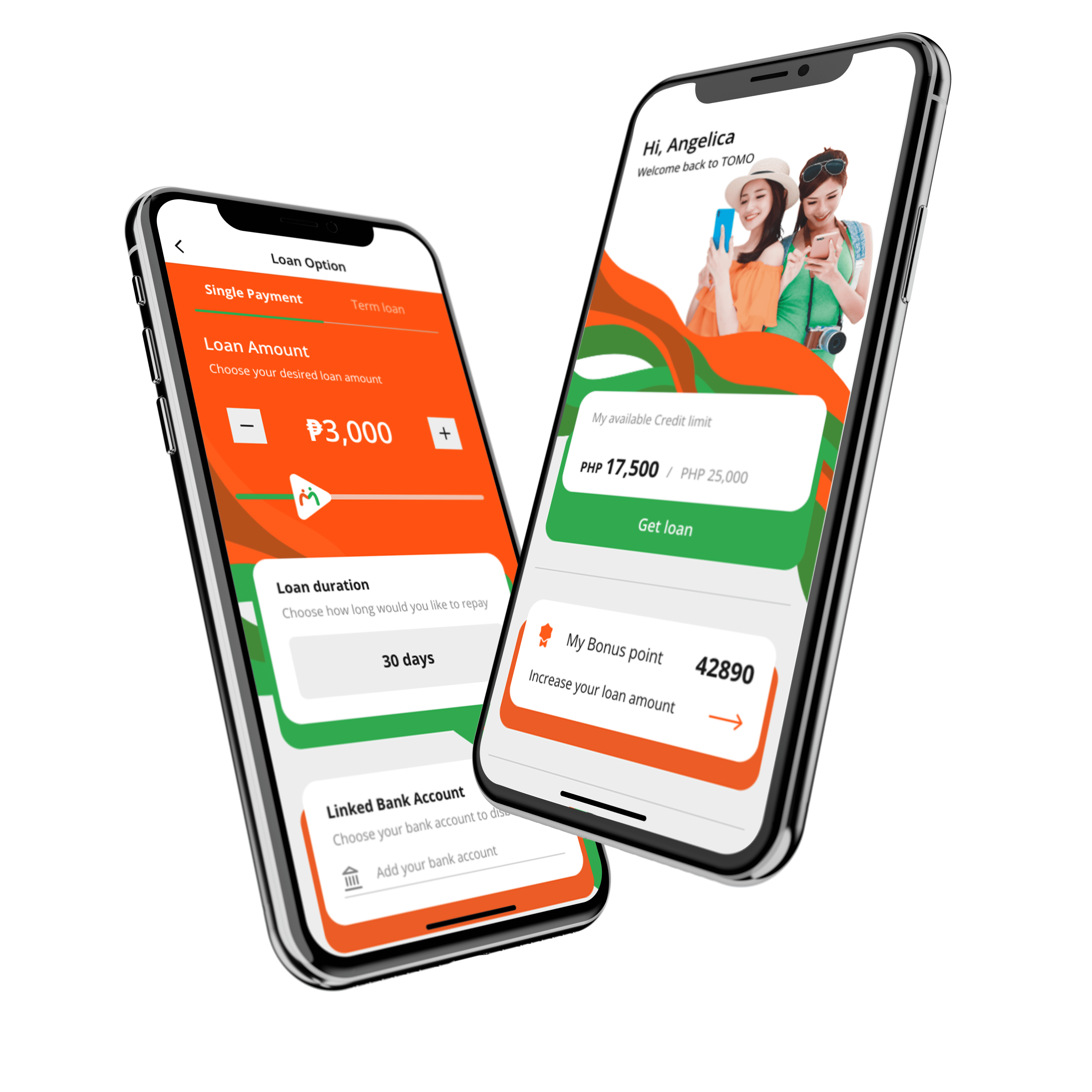

If you’re still unsure about which loan app to choose, let’s take a look at our loan service! We offer fast approval and an easy application process for Manila residents.

63 961 660 0658

63 961 660 0658