In today’s market, numerous services offer loan app services, so it’s essential to select the one that best suits your needs. Before making a decision, ensure you understand how it works and seek out trustworthy loan apps.

Let’s explore the criteria below.

1. Make sure It’s Legal and Compliant:

1.1 Double-check if the app is registered with the relevant financial authorities in the Philippines.

This ensures they follow the rules and regulations and are monitored.

Take a look at their licenses and permits to be sure they are allowed to offer loan services.

1.2 Understand How Your Data Is Handled:

Carefully read their privacy policy and terms of service. These documents should explain how they collect, use, and protect your personal information.

Check for assurances about keeping your data secure and preventing unauthorized access or misuse.

Additional Tips:

1.3 Look at reviews and ratings from other users online.

Compare interest rates and fees from different apps.

Only borrow what you can realistically pay back within the given time.

Remember, your financial safety is crucial. Take your time, do thorough research, and pick a loan app that meets your needs while following the highest standards of safety and legality.

2. Find the Best Fit for Your Needs

Choosing the right loan app depends on matching your needs with the features of the loan type. By understanding each option, you’ll be well-prepared to navigate the loan app options and find the perfect loan for your journey.

2.1 Personal Loan:

Think of a personal loan like your financial Swiss Army knife, suitable for various needs such as debt consolidation, home renovations, or a dream vacation. Offered by banks, credit unions, and online lenders, personal loans have flexible repayment terms with interest.

2.2 Home Loan:

Dreaming of owning your own place? A home loan can make it happen! Secured by your property, this type of loan is specifically for buying a home. Expect longer repayment terms and the choice of variable or fixed interest rates.

2.3 Car Loan:

Planning to buy a new car? A car loan is your reliable co-pilot. Designed for financing vehicle purchases, these loans involve regular payments spread over a set period.

2.4 Micro Loan:

Need a financial boost for your entrepreneurial dreams or small business? Micro loans are your go-to! They offer quick approval, smaller amounts, and shorter repayment periods, perfect for micro-ventures and short-term needs.

Bonus Tip: Before deciding, research and compare interest rates and fees offered by different apps.

3. Interest Rates, Fees, and More

Different loan apps come with different conditions. That’s why it’s essential to take a close look at their interest rates, fees, and any other charges they might have. Some apps even provide loan estimate systems before you apply, so you can see exactly how much you’ll need to repay and manage your finances responsibly after getting the loan.

Here’s what to keep in mind:

3.1 Interest Rates:

These rates can vary based on the lender, your credit score, and the type of loan. Compare rates from different apps to find the best deal.

3.2 Fees:

Many loan apps charge fees like origination fees, processing fees, late payment fees, and even prepayment penalties. Understand all these fees and include them in your total cost calculation.

3.3 Loan Estimate Systems:

Choose apps that offer pre-application loan estimates. These tools give you a clear overview of the total cost of the loan, including interest, fees, and the expected monthly payment. This helps you make informed decisions before committing to a loan.

By carefully looking into these factors, you can confidently choose the loan app that suits your needs and budget. Remember, transparency and affordability are key!

Bonus Tip: Read the fine print! Take the time to review the app’s terms and conditions to understand all the costs and potential hidden fees.

4. Finding the Right Loan Amount and Repayment Term

Getting the perfect loan app is only part of the journey. Now, let’s make sure the loan amount and repayment terms match your needs perfectly.

4.1 Know your needs:

Understand how much you really need. Don’t go for too much or too little.

4.2 Look for flexibility:

Choose apps with a loan range that fits what you’re looking for. Borrowing responsibly is crucial!

4.3 Match your budget:

Pick a repayment term with monthly payments that fit your budget. Consider your income and expenses.

4.4 Convenience matters:

Choose flexible repayment options, like early payments or automatic debits, to avoid missing payments and late fees.

Bonus Tips : a good loan should empower you, not burden you. Choose wisely and navigate the loan app maze with confidence!

5. Fast approval and easy to apply

In today’s fast-paced world, time is valuable. Waiting for loan approval can be frustrating. That’s why choosing loan apps with quick approval and minimal documentation is essential. Look for:

5.1 Fast Online Applications:

Choose apps that let you apply online with minimal hassle. No more paperwork marathon!

5.2 Minimal Documentation:

Streamlined apps require only essential paperwork, saving you time and effort.

5.3 Quick Approval Decisions:

Get a response on your loan application within minutes or hours, not days or weeks.

You’ve done your research, covered all the bases, and now it’s time to find the trustworthy loan app that fits your needs and gives super-quick approval!

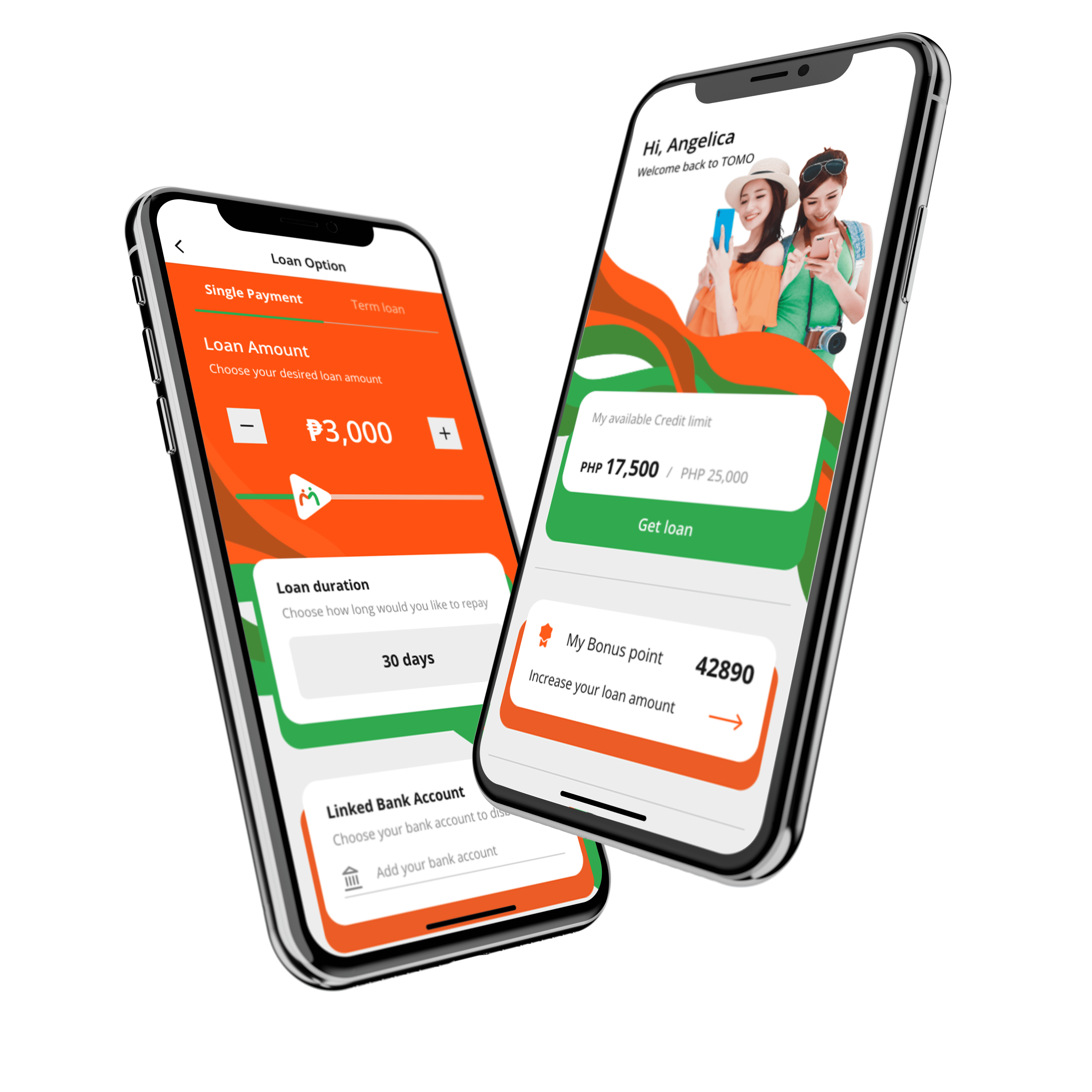

1. etomo

About etomo

- Effortless Approval: etomo boasts fast approval times, ensuring you get the funds you need without delay.

- Hight loan amount: Up to 100,000 PHP with a maximum 12 payment terms.

- Loan Calculator: Understand the terms and repayments better with etomo’s loan calculator.

- Transparency Matters: etomo is committed to providing clear and transparent terms for your peace of mind.

- User-Friendly Interface: Navigating through etomo’s app is intuitive, making the borrowing process a breeze.

Application Requirements :

- Personal & address information

- Employment & financial information

- A valid Govt ID (Driver’s License, UMID, National ID)

- A valid email address

- A valid mobile phone

2. Asialink

About Asialink:

- Instant Cash Solutions: offering different loan products like collateral loans, online lending and financing, used car loan, auto loan, and truck loan.

- Simplified Application: With a user-friendly app, applying for a loan is straightforward and convenient.

Application requirements :

- Filled-out loan application for,

- Official receipt & certificate of registration (OR/CR)

- Proof of income

- The latest picture of the vehicle

- Proof of TIN

3. Atome

About Atome

Pay Later: Atome is known for its Buy Now, Pay Later feature

- 3 equal payments: Split your bill into 3 equal payments. You’ll pay the first payment at the point of purchase. The next two payments will be spread 30 days apart.

- Tailored to You: Atome adjusts its offerings based on your borrowing patterns, ensuring a customized experience.

- Variety choice: Atome partnered with over 5,000 online and offline retailers in the Philippines.

Application requirements :

- Filipinos at least 18 years old

- Active mobile number

- Valid ID with the full legal name

- Vails email address

- A valid debit or credit card

4. Home credit

About Home credit :

- Comprehensive Home Services: Home Credit offers services ranging from home improvement to appliance leasing.

- Financial Support: Secure funds for your home projects and improvements with Home Cradie.

- Efficient Application: Apply conveniently through their user-friendly platform.

- Loan offer : Utilize our rapid cash loans to support your small business, home improvement projects, educational expenses, and various other requirements.

Application requirements :

- One (1) government-issued valid ID that indicates your address AND date of birth. If any of two are not satisfied, a second document ID bearing the missing information from the primary ID will be required for presentation.

- Down payment.

5. JuanHand

About JuanHand :

- Streamlined Application: Apply for loans seamlessly through their user-friendly app.

- Variety of Loans: Choose from a range of loan options catering to different financial needs.

- Loan amount: Up to 15,000 PHP with a maximum of 3 payment terms.

- Secure Transactions: JuanHand ensures the security of your personal information and financial transactions.

Application requirements :

- Filipino citizen

- Between 20 and 60 years old

- Have a stable source of income

- Have at least one government-issued ID

From streamlined application processes and minimal documentation to user-friendly interfaces, these apps revolutionize borrowing. Remember to review each app’s terms and conditions meticulously before making your choice. With these loan apps, you can confidently access the funds you need to address your financial requirements promptly and effectively.

63 961 660 0658

63 961 660 0658