In the bustling city of Manila, managing financial needs efficiently is essential for a smooth and successful life. With the advent of technology, the world of financial services has evolved, offering unprecedented convenience. This is where loan apps come into play. Tailored to the needs of Manila residents, loan apps offer a range of benefits that simplify borrowing and empower you to take control of your finances. Let’s dive into the advantages of using a loan app tailored for those living in the vibrant city of Manila.

1. Instant Access to Extra Money:

Need money quickly? A loan app is your solution. With just a few taps on your smartphone, you can submit your application and receive quick approvals. This means you can address urgent financial needs promptly, whether it’s for medical emergencies, unexpected bills, or time-sensitive opportunities.

2. Effortless Application Process:

Say goodbye to lengthy paperwork and queues. Loan apps offer an easy and streamlined application process. You can complete the application from the comfort of your home or while on the go, eliminating the need to visit a physical branch.

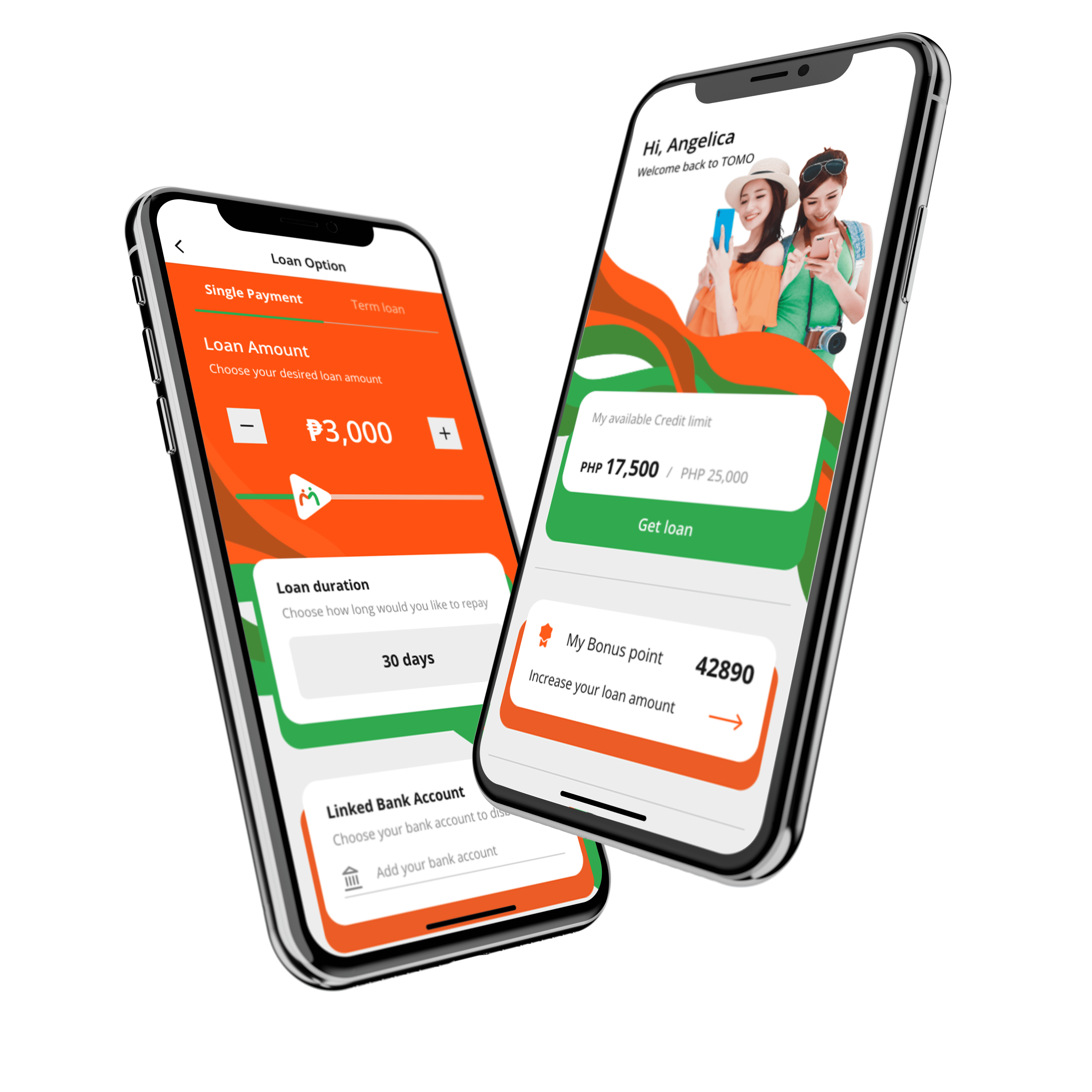

3. User-Friendly Interface:

Loan apps are designed with user convenience in mind. Navigating through the app, submitting documents, and tracking your application status is intuitive and straightforward, even for those not well-versed in technology.

4. Transparency in Terms:

Gone are the days of puzzling over complicated financial jargon. Loan apps present terms and conditions in a clear and concise manner, allowing you to fully understand the interest rates, repayment schedule, estimate your loan before applying, and any associated fees before committing.

5. Round-the-Clock Access:

Life in Manila can be busy, with schedules that don’t always match traditional banking hours. Loan apps offer 24/7 accessibility, empowering you to manage your finances whenever it suits you.

6. Transparent Tracking:

Stay in the loop at every step. Loan apps provide real-time updates on your application status, approval, and fund disbursement, giving you peace of mind and eliminating uncertainty.

7. Efficient Customer Support:

Should you have questions or concerns, most loan apps offer customer support channels to address your queries promptly and professionally.

In a city that never sleeps like Manila, embracing technology can significantly enhance your financial journey. A loan app designed for Manila residents brings a host of benefits that cater to the fast-paced urban lifestyle. From quick approvals and user-friendly interfaces to secure transactions and transparency, using a loan app like etomo simplifies borrowing and puts you in control of your financial aspirations. It’s time to experience the future of lending right in the palm of your hand.

63 961 660 0658

63 961 660 0658