Budgeting is a fundamental skill that empowers individuals to take control of their finances, achieve their financial goals, and build a secure future. However, many people find the idea of budgeting daunting or overwhelming. In this guide, we’ll break down the basics of budgeting and provide practical tips to help you create a budget that works for you and stick to it effectively.

- Understanding Your Income and Expenses:

- Start by identifying all sources of income, including your salary, freelance gigs, or any other additional earnings.

- List out all your expenses, categorising them into fixed expenses (like rent/mortgage, utilities, and loan payments) and variable expenses (such as groceries, entertainment, and transportation).

- Setting Financial Goals:

- Determine your short-term and long-term financial goals, whether it’s saving for a vacation, paying off debt, or building an emergency fund.

- Prioritise your goals based on their importance and urgency, allocating funds accordingly in your budget.

- Creating a Budget:

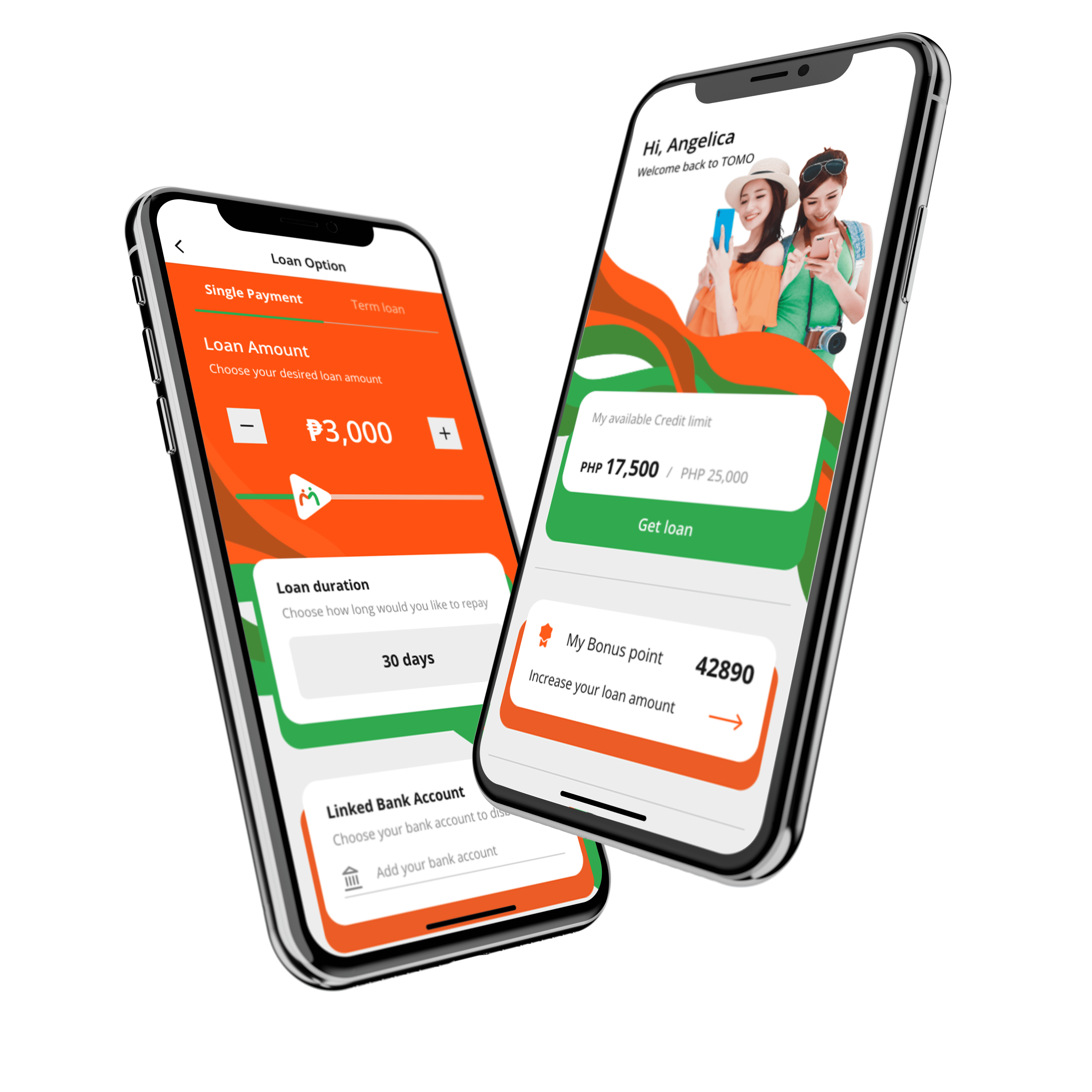

- Use a budgeting tool or spreadsheet to organize your income and expenses. Allocate a specific amount to each expense category based on your financial goals and priorities.

- Be realistic and flexible when setting budget limits. Leave room for unexpected expenses or adjustments as needed.

- Tracking Your Spending:

- Regularly track your spending to ensure you’re staying within your budget. Keep receipts, use budgeting apps, or maintain a spending journal to monitor your expenses.

- Review your spending regularly to identify any patterns or areas where you can cut back.

- Adjusting Your Budget:

- Life changes, and so should your budget. As your income or expenses fluctuate, be prepared to adjust your budget accordingly.

- Evaluate your budget periodically and make necessary changes to align with your current financial situation and goals.

- Strategies for Sticking to Your Budget:

- Set specific, measurable, and achievable financial goals to stay motivated.

- Use cash envelopes or digital budgeting apps to track your spending in real-time and avoid overspending.

- Practice self-discipline and avoid impulse purchases by sticking to your budget limits.

- Find alternative ways to save money, such as meal prepping, DIY projects, or finding free or low-cost entertainment options.

- Reward yourself for sticking to your budget milestones, but be mindful not to derail your progress with excessive spending.

Creating and sticking to a budget is a foundational step towards achieving financial stability and success. By understanding your income and expenses, setting clear financial goals, and implementing practical strategies for budgeting, you can take control of your finances and work towards a brighter financial future. Remember, consistency and discipline are key to long-term budgeting success.

63 961 660 0658

63 961 660 0658