A credit card is often issued by banks, it allows cardholders to borrow funds for purchasing goods and services that accept credit cards for payment. Credit cards impose the terms that money borrowed must be paid back plus applicable interest and agreed-upon additional charges if there are any. People who are eligible for obtaining these should be at least 18 years old, have a good credit score, and meet the minimum income requirements specified by the card lender.

Credit cards have become an essential life tool nowadays, they can be used to make purchases you cannot afford to pay in full just yet. They are very convenient because majority of businesses like hospitals, universities, shopping malls, and restaurants already accept credit cards as payment, you also won’t have to deal with the hassle of going to the atm or banks to withdraw money, and it gives you more purchasing options with just your phone since it can also be used for online purchases. After making a purchase, it’s also important to pay your credit card balance in full and on time during each billing to avoid additional fees and charges as well as to avert too much debt.

Some credit cards also give you rewards every time you spend, these can be in the form of discounts, cashbacks, gift cards, or miles. The more you use your credit cards, the more you earn rewards, you can redeem these, or you can also choose to save it for the future. Most credit cards also come with low introductory rates, it gives you the ability to use your card initially and pay off your balance over time without incurring interest.

In general, credit cards can help you build good credit scores and are very handy in emergencies. It can help you cover an unexpected expense if you can’t afford to pay for it in cash for now. If not used wisely and carefully, credit card debt can be a vicious cycle to get into, you are using money that isn’t yours and/or you don’t have yet. It can all be avoided by not charging more than you can afford to pay off, and by making payments on time.

People use credit card debts to finance many things in their lives and this is just one of the benefits of owning one. An awareness of these things can help you decide how you will be using a credit card and controlling the risks, because ownership of credit cards also comes with great responsibility, so is it up to you how you’ll make good use of this.

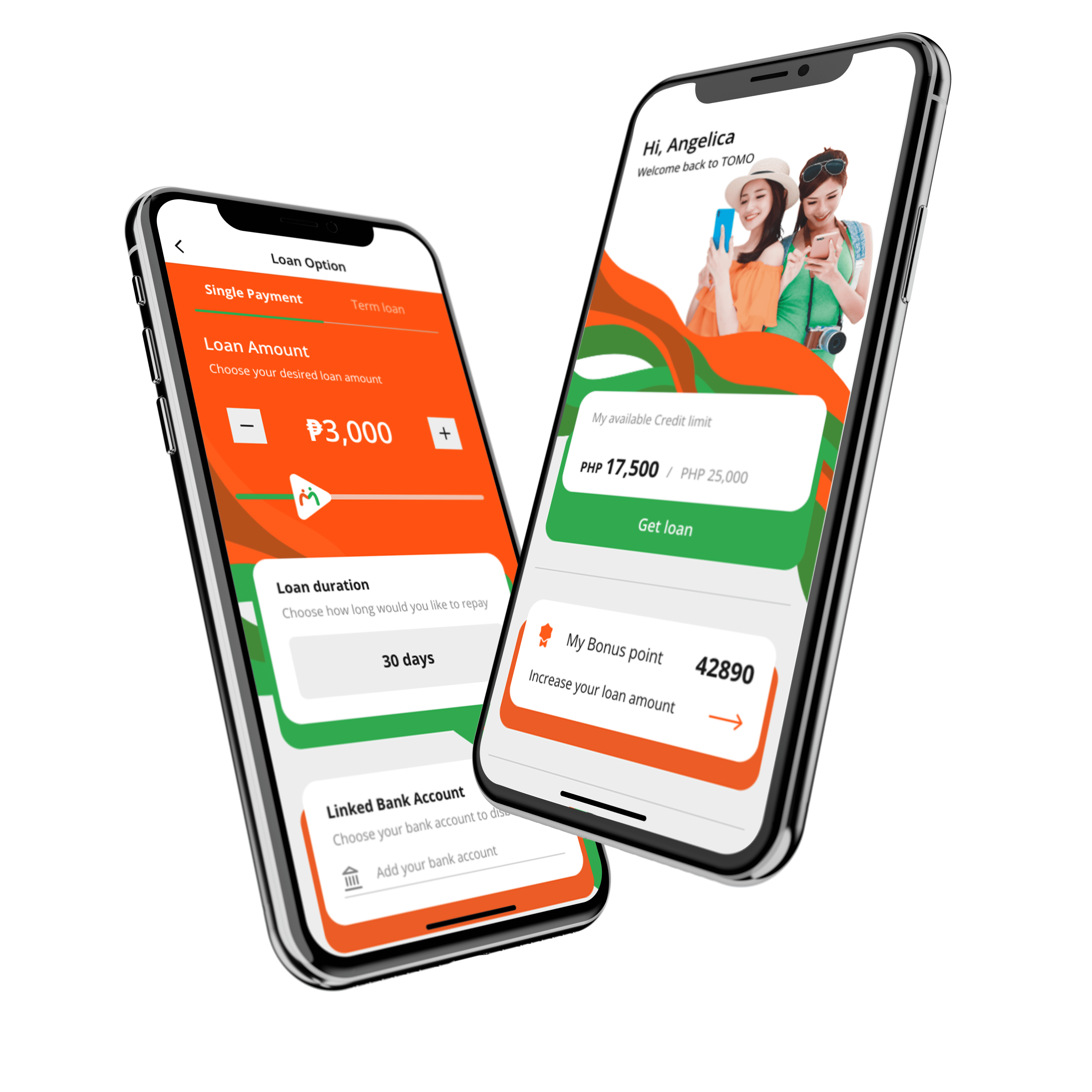

AND Financing Corporation will be launching a product that works exactly like a credit card, it is called Cashabay and it is a card-less credit line that can be used to pay for goods and services. With the help of just your phone, you can have available credit anytime and anywhere. You can monitor our website for updates on when Cashabay can be availed.

63 961 660 0658

63 961 660 0658